Home Depot Project Loan In 2022 (How It Works + More)

|

|

LoanDepot Park in 2012

|

|

| Former names | Marlins Park (2012–2020) |

|---|---|

| Address | 501 Marlins Way |

| Location |

Miami , Florida |

|

Coordinates |

|

| Public transit |

Free City of Miami Trolley from Civic Center Marlins Shuttle [1] from Culmer |

| Parking | Four main parking garages and six surface lots |

| Owner |

Miami-Dade County |

| Operator |

Miami Marlins LP |

|

Capacity |

36,742 37,442 (with standing room) [2] 34,000 (Football) [3] |

| Record attendance |

37,446 (March 11, 2017 World Baseball Classic. USA vs Dom. Rep.) [4] |

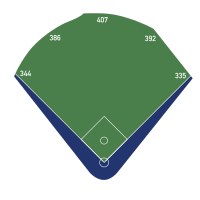

| Field size |

Left Field Line – 344 ft (105 m) Left-Center Power Alley – 386 ft (118 m) Center Field – 400 ft (120 m) Right-Center Power Alley – 387 ft (118 m) Right Field Line – 335 ft (102 m) Backstop: – 47 ft (14.3 m)  |

|

Acreage |

928,000 sq ft (86,200 m 2 ) |

| Surface |

|

| Construction | |

| Broke ground |

July 1, 2009 (Start of construction preparations) July 18, 2009 (Ceremonial Groundbreaking) [6] |

| Opened |

March 5, 2012 ( High school baseball game) March 6, 2012 (exhibition game) April 1, 2012 (spring training game) April 4, 2012 (regular season) |

| Construction cost |

US$634 million [7] ($715 million in 2020 dollars [8] ) |

| Architect |

Populous [9] |

| Project manager |

International Facilities Group [10] |

| Structural engineer |

Bliss & Nyitray, Inc (bowl and track) Walter P Moore (roof) |

| Services engineer |

M-E Engineers, Inc. [11] |

| General contractor |

Hunt / Moss Joint Venture |

| Main contractors |

MARS Contractors Inc. [12] John J. Kirlin, LLC. [13] Structal – Heavy Steel Construction, A division of Canam Group (roof) [14] |

| Tenants | |

|

Miami Marlins ( MLB ) (2012–present) Miami Beach Bowl ( NCAA ) (2014–2016) |

|

Home Depot is now the number one choice for people who want to renovate their homes. It offers a range of tools and supplies as well project loans.

A Home Depot project loan is a financial loan of up to $55,000 from Home Depot as of 2022 to spend in stores or for renovation-related expenses. The customer’s credit approval will determine which tier they are on.

What Is A Home Depot Project Loan?

Home Depot can provide a loan to help with renovations if the funds are not available.

The project loan has fixed monthly payments, with the flexibility to pay your project loan off early.

You don’t have to pay an annual fee for the Home Depot Project Loan. It can also be used to buy all project materials.

What’s the Cost of a Home Depot Project Loan.

Home Depot loan can be used to purchase up to $55,000 and you will have to repay the loan in monthly installments for up to seven years.

It all depends on how creditworthy you are. Home Depot can offer a loan with variable APR for up to six months.

The APR amount on the Home Depot project loan loan is fixed throughout the term of the loan and requires no down payment.

How Much Can I Repay With A Home Depot Loan?

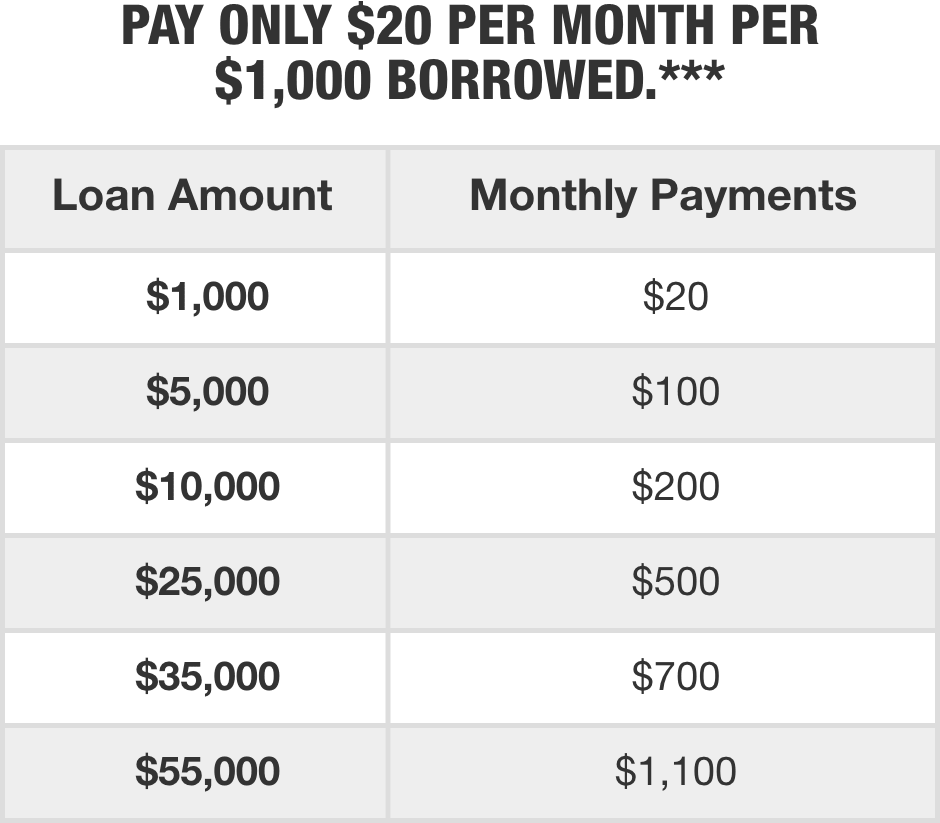

You will repay a percentage of your loan each month depending on how much you borrowed for the Home Depot loan.

Home Depot states that the project loan repayment will not be more than $20 per $1000 spent.

This is how the monthly amount will change depending on how much your loan has been.

What is the best way to apply for a Home Depot Loan?

Apply online for a Home Depot Project Loan by going to the Home Depot Credit Center.

This is the exact same procedure as applying for another credit card at Home Depot.

You will need personal information, such as your name and location, along with your credit history, to apply for the Home Depot project loan.

A co-applicant can also apply for the Home Depot loan. They will need to provide their information.

What is my credit score for Home Depot Project loans?

Home Depot projects loans require a minimum credit score of 620.

Home Depot will contact you once you submit your information.

What is the maximum length of my Home Depot Loan?

You have six months to order everything needed for your project at Home Depot with your loan.

When you get approved for the loan from Home Depot, the period of spending begins.

How do I make payment for my Home Depot project loan?

To pay off your Home Depot project loan, you can make payments either by mail, phone, or online.

To pay by mail, you can send your checks to the Home Depot Loan Services at this address: Dept #3025, The Home Depot, P.O. Birmingham, Alabama 35287-3025.

You can also pay the Home Depot loan via telephone by dialing 877-476 3860, and follow the directions of the associate.

Online payment of your Home Depot loan can be done at thdloan.com.

How can I pay my Home Depot loan off early?

Home Depot customers can pay their loan earlier than usual by using the Home Depot credit card.

You will not be subject to a prepayment penalty if you pay off your Home Depot project loan before the due date.

Do you need to be approved for a Home Depot Loan?

The Home Depot Project Loan loan application must have good credit.

It has been noted online, however that good credit does NOT guarantee you’ll be approved for a Home Depot loan.

Home Depot will provide you with an estimate of your loan eligibility once you have submitted the form.

How do I handle a Home Depot Loan Denial?

If you are denied a Home Depot project loan, you can contact Home Depot credit services to learn why you were denied and receive advice on how to proceed.

Home Depot loyalty programmes, along with other financing options such the Consumer Credit Card, can all be useful for funding renovation projects.

Lowe’s and other competitors offer financing and credit options that are similar to Lowe’s for renovating projects.

If you are looking for the best way to apply for a loan, it is worth visiting Lowe’s, Home Depot or other similar retail stores.

Home Depot provides credit services. For more information, please visit our similar posts: Home Depot Pro Xtra; Home Depot Improver Credit Card and if Home Depot allows layaway.

Home Depot’s project loan is an excellent option to fund large-scale renovations.

It requires good credit scores, but it offers monthly payments options with no penalty for early repayment.

You have the option to pay your Home Depot project loans online, by post, or over the phone, according to your preferences. You can pay your Home Depot loan at any interest rate. It is set for the term of the loan.

What Interest Rate is Home Depot Project Borrow?

7.99%

How Does The Home Depot Project Card Work?

This card is ideal for those who plan on making a large investment in their home. It provides a credit line that can be used to finance big projects, and it allows them to pay off the debt over a period of up to 7 year. The APR for 7 years is fixed. After being accepted, you have six months to spend what you want to.

Home Depot Offers Project Financing

Home Depot’s project loan is a credit line geared toward people who shop at Home Depot and want to finance home services and improvement projects. You may find it a great alternative to Home Depot Consumer Credit Card. The fixed interest rate is low and the credit line ranges between $1,000-$55,000.

How can I use my Home Depot Project Loan Card card?

The Home Depot Project Loan is more restrictive than a personal loan issued through a bank. In a way, it functions like a preloaded card credit that can be used at Home Depot locations and on the website. The card cannot be used at other places. July 30, 2021

.Home Depot Project Loan In 2022 (How It Works + More)