Does Ups Do Money Orders

Definitions for Section 7030

This chapter defines the terms that are used.

If you liked this, you might also be interested in

Costco Executive Membership Hours

7030.10 -MOD. This is the abbreviation of the Money Order Division of the USPS Postal Data Center at St. Louis, Missouri, which has accounting and auditing control over money orders.

If this was up your alley, you might appreciate

Does Cvs Do Cash Back

7030.15 -Money Order. Unless otherwise qualified, this term means the Postal Money Order that has the ABA routing number 0000-0020 or 000000204 shown on the form.

7030.20 -Replacement Money Order. A money order issued by the USPS to replace another money order. It will contain a different serial number (starting with 99) but will not be subject to any special processing by the FRBS.

7030.25 -Fit Money Order. A money order that can be completely processed on high speed processing equipment.

If you enjoyed this, you might like

Does Walmart Make Keys

7030.30 -Mutilated Money Order. Money order that is not suitable for high-speed processing. Money orders with unreadable MICR symbols in the “on-us” field are not included.

Old Style Money Order. A card style money order bearing ABA routing number 0000-0119.

7030.40 -International Reissue Money Order (Appendix No. 1). This money order appears similar to the Domestic Money Order; however, the validation plate on the money order is preprinted, not imprinted, and no monetary limitation is shown on the face of the money order. These money orders are negotiable for a maximum of $400.00, as noted on the reverse of the document. Serial numbers for International Reissue Money Orders will all begin with the number “89.” Unlike domestic money orders, international money orders are valid for a period of only I year. On the front of the money order is the expiration date. These money orders, if presented during the validity period, should be treated the same as domestic money order.

7030.45 -Domestic-international (Semi-domestic) Money Orders (Appendix No. 1). The United States accepts money orders issued by these 14 countries. Appendix No. 1 gives a list of the 14 countries that issue the money orders.

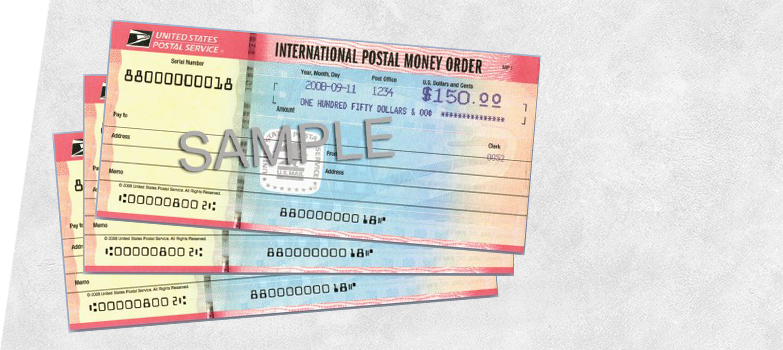

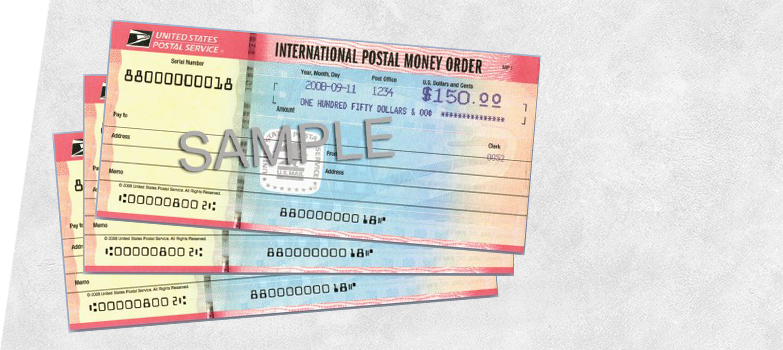

International Postal Money Orders, Appendix Number 7030.50 1). These money orders are similar to domestic and international reissue money orders. The serial number of all international money orders begins with “88.” The lower right-hand corner of these orders is annotated “Not negotiable in USA.” Any international postal money orders deposited by a member bank should be returned to the presenting bank so that the bank may recover funds from the customer who presented it for payment.

Appendix Number 7030.55-Non-Negotiable Money Orders International (Appendix No. 1 ). These are foreign money orders, other than semi-domestic, and cannot be accepted for payment in the United States. These money orders, purchased in foreign countries and mailed to persons in the United States and cashed at local banks, should be charged back through banking channels to the original endorser. Money orders are primarily received from France and Germany. They also come in large numbers from Australia, Great Britain. Belgium, New Zealand, Great Britain.

7030.60 -Bank No. or FRB Code (Appendix No. 1 ). The four-digit FRB routing code is referred to as this term. This number is to be used on various documents for charging or shipping of money orders to USPS.

7030.65 -Batch. This is a group of paid money orders placed under one control total (or subtotal) by the FRB. A separate USPS Batch Locator Control Document will precede the items in each batch. A batch of unmutilated or fit money orders should not exceed 200 pieces.

7030.70 -USPS Batch Locator Control Document (Appendix No. 1). The USPS Batch Locator Control Document is a preprinted document furnished by the USPS to the FRBS. The document is inserted at intervals of not more than 500 money orders by the FRB. It is sequentially numbered and each sequence should be maintained in the insertion of the document.

7030.75 -Batch Number. This is a 7-digit sequential number shown in the OCR and MICR read line of the USPS Batch Locator Control Document.

7030.80 -Reasonable Tolerance. The term “reasonable tolerance” is used by USPS when it verifies the charges for money orders paid to the FRBs as shown on PS Form 1175, Recapitulations of batch totals. If the USPS finds that the amounts are slightly different from what was indicated in the PS Form and does not want the USPS to adjust the USPS.

Box Labels (Appendix Number) 1). FRBs are to be advised that the front end of each box of money orders forwarded to the MOD will be labeled to show the FRB Code, transcript charge date, box number, and total number of boxes in the shipment.

Why Don’T Ups Do Money Orders?

The company offers a variety of services but does not sell money orders. It could also be because the company lacks incentive, as many companies provide the same services.

Why should customers use UPS as a courier and shipping company when there are other options?

If UPS starts offering money orders and market them well, then people would definitely buy from them, and it will help to give their profit a boost; however, with such a tough commutation in this well-saturated market, it just seems like a good decision that they don’t offer money orders.

UPS does not allow you to transfer money. Not directly from the UPS stores and not through UPS shipping services. It is illegal to use UPS services for money transfers. You should also be careful in sending other forms of financial instructions through courier as well.

Related: Does UPS Have A Reward Program?

Why does Ups not accept money orders or sell them?

As previously mentioned, UPS is neither a bank nor a financial institution; it does not sell or transfer cash.

Banks, credit unions, and money transfer agents are the most common money transfer providers. A money transfer agent is an objective third-party company or organization that assists in transferring securities.

Another reason UPS does not provide money transfer services is that it is unrealistic. It’s likely that UPS lacks incentives because many companies offer similar services.

This payment method often requires the assistance of a financial institution or money transfer agent with greater cash amounts. This could be a security risk for UPS personnel, especially because most UPS facilities are insecure.

Money Order Frauds: Typical Money Order Schemes

Most money order cons involve sending you (the victim) a bogus money order as payment for a purchase or other transaction, persuading you to deposit the funds in your checking account, and then getting you to take further action before the fraud is discovered.

The variations on this scheme are almost endless. Criminals are resourceful. But the most well-known ones include:

Depending on how good a forged money order is, it could take more than a week after you make your deposit for your bank or credit union to discover the fraud. To capitalize on that delay, crooks often try to create a sense of urgency to hurry their shady transactions along. Scammers may play on sympathy, for example by stating that cash was needed to cover a medical crisis. Some go for intimidation–demanding an immediate refund on an item they claim is unacceptable, for instance. Others play on your fear by claiming that you need to act immediately in order to rescue a victim of kidnapping.

Does Ups Sell Or Cash Money Orders In 2023?

UPS doesn’t sell or cash money orders 2023. This is because UPS is a logistics and shipping company, and while it offers some financial services, it’s not a bank or financial institution obligated to offer money order services. Common places that sell or cash money orders are grocery stores like Walmart, banks, corner stores like Walgreens, and the post office.

If you’re looking to purchase or trade in a money order for cash, be sure to check out the rest of the article to find out the fastest and cheapest places that offer money order services!

Charges for Postal Money Orders

FRBs prepare SF5515 “Debit Voucher” for the 8-digit Accounting Station Code or Agency Location Code (ALC), 18-00-0105, to charge postal orders based upon cash letters and other deposit documents that accompany postal money order documentation. To correct under-charges for money order charges made in the original SF5515 charge, another SF5515 must be created and processed. If an overcharge is made on the original SF 5515, the FRB will process an SF 215 “Deposit Ticket” for the amount overcharged to ALC 18-00-0005. Appendix no. Appendix No. 1 contains instructions on how to distribute the SF 5515 and 215 Line 14-A of the FRBs Daily Balance Wire from BGFO must show the net amount for all deposit tickets and debit vouchers reported to ALC. The amount shown on the FRBs Daily Balance Wire to BGFO must be reconciled with the copies received by MOD in St. Louis Missouri of all debit vouchers, deposit tickets, and confirmations.

PS Form 1901 “Advice of Classification for Postal Money Orders” is basically a reconciliation form prepared by the FRB. Certain data from the SF’s 5515 or 215 (confirmed date, document, number, and amount) will be. The block “Charge for ALC 18-00 0005” will be shown. The total amount of this block must match the amount of money ordered by postal money order. This includes the number of orders, the code and the amount. The money order documents will be shipped to MOD, St. Louis, Missouri. Adjustments of errors made on previous shipments will also be reported under the “Classification of Postal Money Orders” block and supported by completing the “Schedule of Adjustments Entered Under Code 003” shown at the bottom of the PS Form 1901 (Appendix No. 1). NO COPIES OF THE PS FORM 1901 WILL BE SENT TO TREASURY.

Each PS Form 1901 is accountable to USPS, therefore, if the FRB voids a PS Form 1901, send all copies to:

These voided copies should not be included with the shipment of money orders. Processing and Control Division Accounting Section should be notified in writing if the PS Form 1901 has been destroyed.

Has UPS ever offered money orders?

Money order services are not something that UPS offers. UPS began as a delivery and shipping business, and it has achieved great success internationally.

Throughout decades, they expanded their offerings, but delivering money orders was never one of those.

UPS does not seem to offer this service, as it is offered by a separate company. They made the correct decision to reject money orders given the difficult trading conditions and crowded marketplace.

How Do I Spot A Fake Money Order?

Remember that thieves can purchase a $1 money order and then tamper it with the intention of increasing its value.

Or they can create a completely fake money order and try to pass if off as real.

There are two important factors to consider when spotting fake money orders.

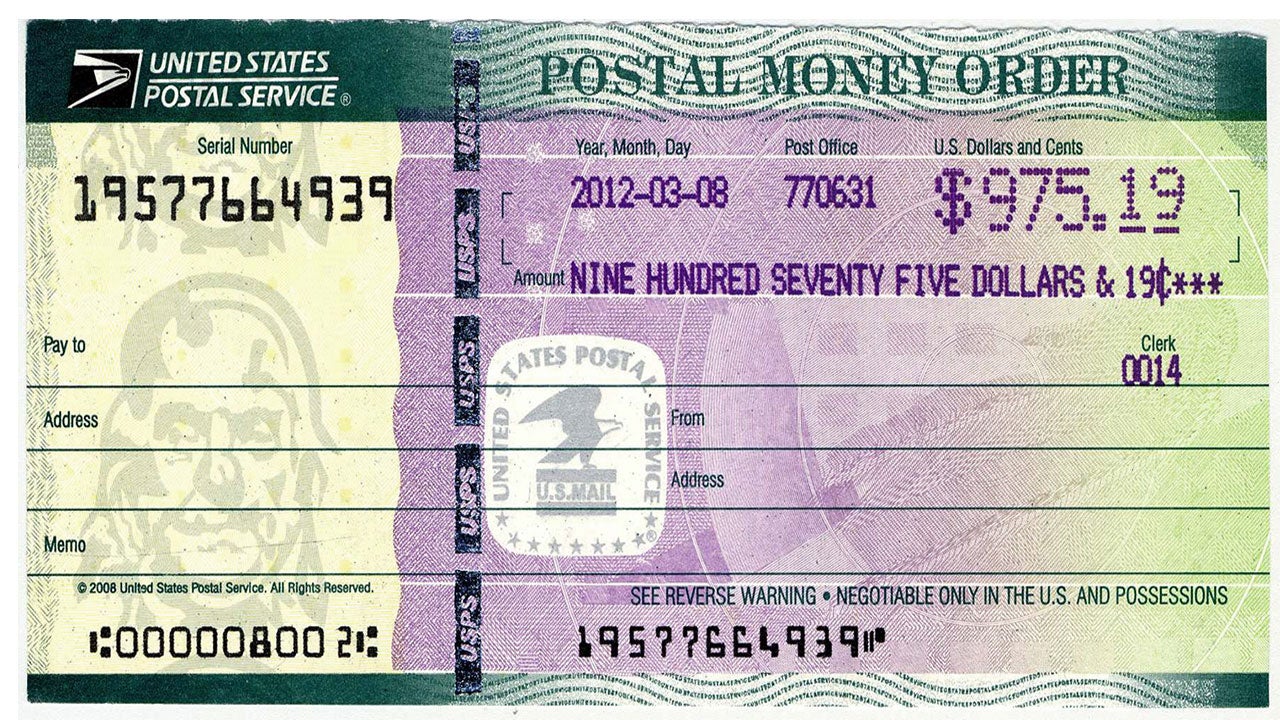

1. Check the Dollar Amount – Does the dollar amount on the money order appear to be fuzzy or discolored? It’s possible that someone has tried to replace the original number with a bigger one.

Also, if the amount is over $1,000 it’s probably a fake. Money orders can only be worth up to $1,000 in the United States and $700 internationally.

2. Examine the Paper – Hold the money order to a light (or at an angle) and check for a watermark.

If you don’t see a watermark you know it’s a fake.

Ben Franklin is a watermark on the left of USPS money order.

MoneyGram’s watermark has both a logo and a stop sign that is heat sensitive. It changes colour when your finger touches it.

Western Union uses ink and a watermark that runs when the money order has been altered.

Before you try to cash a counterfeit check, call the issuing company.

Western Union: 1-800 325-6000

Money Gram : 1-800-666-3947

– USPS Verification System: 1-866-459-7822